Introduction to GST in India

With the slogan of “one nation, one tax” BJP government has succeeded in welcoming GST or goods and services tax in India.

Invasion of GST promises many bright beginnings in the current economic scenario. Obviously, GST and its impact will lead future of Indian economy. This is a major event in the history of Indian economy.

With GST in the picture, there will be one single tax in spite of multiple taxes. With the lot of news and buzz GST is being seen as the future tool to speed up the economic growth. There are many speculations in terms of job creation.

Before India, there were many countries which already had GST. France, China (partial GST), Malaysia and few others are amongst those countries. In the past 5 years Congo, Seychelles, Gambia, and Malaysia have been most recent GST implemented countries.

There are different types of taxes at both state and central level.

At center level

- The special additional duty of customs.

- Service tax

- Additional customs duty.

- Central excise duty.

At state level

- Taxes on lottery

- Purchase tax

- Luxury tax

- Entry tax

- Entertainment tax.

- Sales tax.

Thus at every level, you have to pay many different types of taxes at every tier. This system somewhere has been the reason for existing corruption.

As this in this type of taxation system is difficult to keep track. It is more often that people hide their black money in some or the other way.

So coming of GST has made the task of keeping tax tracking easy. It’s obviously not easy to hide if you have a single one-time tax as compared to before.

With all these basic points in our mind let’s dig up a bit deeper to know GST and its impact in deep.

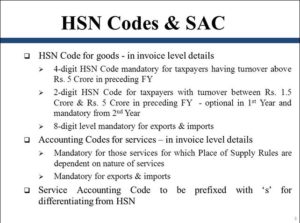

HSN codes; HSN codes or Harmonized commodity description and coding system is the system of creating the unique code for every sales commodity. It’s a multipurpose international product nomenclature.

Developed by world customs organization popularly known as WCO. This classifies a product in six digit code which constitutes sections, heading, subheading, and chapters.

India has been a part of WCO since very long. In India, HSN codes are being used since 1986. These help inconvenient classification.

- Dealers having the annual turnover of 1.5 crores to 5 crores will be using 2 digit HSN codes for their products.

- Dealers with annual turnover less than 1.5 crores will not use any HSN codes.

- Dealers with the annual turnover of 5crores and above will be using four digit HSN codes for their goods and services or commodities.

- Import/export dealings will require eight digit HSN codes.

Basically, HSN classification has 21 sections, 99 chapters and 1,244 headings and. 5,224 subheadings to classify commodities of the different arena. There are several set rules which require stepwise practice to completely classify goods.

As India has turned away smarter by adopting GST. It will be essential to adopt HSN codes for creating invoices, filing returns and much more. With footsteps of GST in India HSN codes usage and significance has achieved a new height.

It needs guidance and homework to understand the new system. But hopefully, if the purpose is satisfied then it’s worth pain. After all, there is no gain without pain

Tax slabs

With GST in India there have been slight changes in the tax slabs for every group of individuals let’s have a deep look into it for more clear and transparent vision;

Table 1 For individual tax payer below 60 years of age (male & female)

| Income | Tax |

| 2,50000 INR INR | Nil |

| 2,50 000- 5,00000INR | 5% |

| 500000-1000000 INR | 20% |

| More than 1000000 INR | 30 % |

Table2: For senior citizens up till 60 years of age.( male & female ) Not more than 79 years.

| Income | Tax |

| 300000 INR | Nil |

| 300000-500000 INR | 5% |

| 500000-1000000 INR | 20% |

| More than 1000000 INR | 30%

|

Table 3: For senior citizens 80 years of age or more. ( male & female).

| Income | Tax |

| 2,50000 INR | Nil |

| 2,50 000- 5,00000INR | Nil |

| 500000-1000000 INR | 20% |

| More than 1000000 INR | 30 % |

FY tax alterations 2017-2018

| Income | Alteration |

| 2.5 lakhs to 5 lakhs | 5% not 10% as before |

| 5 lakhs to 10 lakhs | 20% |

| 10 lakhs | 30% |

| 50 lakhs -1 crore. | 10% surcharge |

| 1 crore | 15% |

With these changes now you know your income tax rates after GST is in the financial system. Hopefully, these will lead to FastTrack and speeded national growth. Paying taxes will be easy and hiding or stealing any kind of tax will be difficult.

Invoices formats

With changes in the financial scenario under GST, there are many accompanying changes. Invoicing under GST also has few new aspects which should surely catch your eye.

Specific mandatory keys points in GST compliant invoice. It’s essential to claim ITC before issuing or receiving a GST compliant invoice. Following areas should be kept in mind:

- Customers name.

- Invoice number and date.

- Shipping and billing address.

- Place of supply.

- Customers and taxpayers GSTIN

- Taxable value

- Discounts

- HSN codes

- Item detail

- Rate and amount of taxes.

There are different types of invoices:

- Purchase invoices.

- Bill of supply.

- Debit notes.

- Advance receipts.

- Refund vouchers.

- Credit notes.

- Sales invoices.

Issuing invoices;

Supply of goods: ( in triplicate)

- Triplicate for the supplier.

- Original for the recipient.

- Duplicate for the transporter.

Supply of services ( in duplicate )

- Duplicate for the supplier.

- Original for the recipient.

The difference between invoice date and due date: Invoice date refers to the date when the invoice was issued while due date refers to the date up till which the payment against the invoice is due or remaining.

Impact of GST on major stream sectors; The major sector of economy will be affected by GST in major ways let us find out how ?;

1. Freelancers: This sector has been most exploited. Often the fragile and undefined rules and regulations have made freelancing a very chaotic industry. The provision of accountability and transparency is a big deal. With GST in this industry, it will be easier file taxes. This will also increase accountability and coherence.

2. FMCG: Elimination of multiple taxes will surely benefit this sector. Savings in the logistics and distribution cost will benefit both manufacturers and consumers. Excise duty, VAT, and entry tax will be replaced by single GST.Startups: Lesser confusion in single GST regime will surely benefit the startups in India.

3. Logistics: It is the soul of the economy. Incoming of GST shall help in strengthening the backbone of country’s economy.

4.Pharma; Making a level playing ground for drug manufacturers. It will surely benefit the health care and pharma industries. The incoming of GST will make high-quality health care affordable to all.

5. Textile: This is the sector of major employers. Speculations are being made that incoming of GST will increase the work and employability. This sector will also be benefitted. The cotton value chain is the major area which will be affected by GST.

6. Agriculture: Covering 16% of the GDP it is the most discussed sector of Indian economy. Reducing the transport cost will help in price reduction under GST. Providing the first national market for agricultural products will be another major development under GST regime.

7. Telecommunications: Telecommunications sector will have significant development due to GST. Efficient inventory management and consolidated warehouses will help in reducing logistics cost.Real estate: This is another major sector of an economy. The description of this sector is most susceptible as it is based on tax rates. The only sure benefit from GST in this sector will be increased transparency.

Conclusion. :

The date of 1st July a very crucial impact of Indian economy. It seems that Goods and services tax will put up wheels on India’s development. There have been three major changes under GST return computation:

- Reduction of prices; Manufacturers /Wholesalers /retailers all will be happy this time by GST. Subsuming all VAT, excise, service tax the cost will be reduced. GST will lower the total cost.

- Substituting of excise duty: Manufacturers pay excise on whatever they produce. In GST excise duty will be subsumed. This will benefit the end consumer.

- Lowering input tax credit: For whole sale retailers, there will be lowering in the input tax credit.

Tax estimation in interstate sale

IGST is the new law under GST. CST was charged for moving goods inter states but now with coming of GST, there will be the single tax levied on the movement of goods between states.

Manufactures and consumers will see the cost reduced under GST. Sale between inter and intrastate will be easier and cheaper. Surely GST and its impact will be a curious pursuit for all of us.

“Stay Informed and connect to Todaysera for the latest updates.”

Recommended: http://www.ndtv.com/india-news/gst-is-here-how-it-will-impact-you-in-10-points-1719130